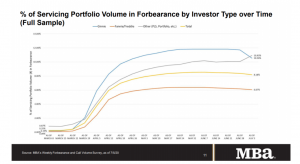

Meanwhile, half of American households have lost a portion of their income due to COVID. Lenders have been exploring ways to suspend or reduce mortgage payments to keep borrowers afloat and the economy churning. The reality is these payments will continue to compound and without the opportunity to earn at pre-COVID rates millions of borrowers will be at the brink of foreclosure.

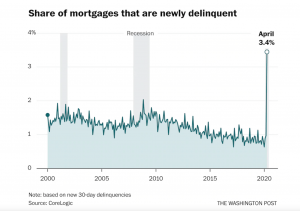

During the last recession (Great Recession) around 4 million homes were lost to foreclosure. The rise in home equity, low borrowing cost, and government stimulus have kept owners better positioned to weather an economic downturn this time around. According to Core Logic’s Delinquency Rates models, the next 18 to 24 months could see an increase of around four times resulting in around 3 million borrowers at risk of foreclosure.

With an increase in foreclosures, we will see an influx of properties on the market. Many stressed buyers have bills that are becoming increasingly difficult to manage as the pandemic continues. Raising the question for stressed buyers, “is the premium I pay to live near good schools, boutique stores, entertainment venue, and organic grocery store justified?” It may not be worth it if you are essentially paying to supervise your child from their laptop, or can no longer comfortably peruse the neighborhood amenities. Neighborhoods like this are commonplace in Los Angeles and over the last 8 weeks, there has been an increase in price as demand outweighs supply. The buyer demand will likely decrease if unemployment remains at a record high (16.3% in California) and stimulus packages aren’t renewed. Tack on an increase in supply as a result of homeowners who held off on selling during COVID beginning to enter the market and there will be a shift to a more buyer-friendly LA real estate market.