In 2020 Q1, Los Angeles County had a vacancy rate of 2.8% compared to the national vacancy average of 5.2% for industrial property. Los Angeles County has now had 23 straight quarters in which vacancies have not exceeded 3%, according to a Kidder Mathews industrial report. The success can be attributed to a greater demand for e-commerce, 3rd party logistics, storage, and warehousing.

It has not been all glitter and rainbows for the Los Angeles County market. Flags began to appear in the last quarter of 2019 due to growing tension with China. With a trade war underway, the volume of product moving to and from ports decreased and manufacturing suffered. In the first quarter of 2020, Los Angeles County saw the highest net negative absorption since the 2008 crisis. The San Fernando Valley alone lost 734,000 square feet of industrial space.

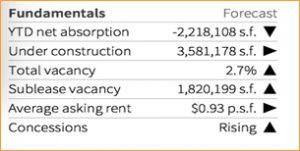

JLL 2020 Q1 Fundamentals Forecast Los Angeles County

With a stay at home orders and other health mandates wreaking havoc on commercial real estate, there is a lot of speculation on how the pandemic will shake up the industry. While the retail market has been a virtual halt, e-commerce is picking up the slack. Sales and the number of individuals making online purchases have grown significantly. April alone saw a 49% increase in E-commerce and a 34% increase in sales according to Adobe’s Digital Economy Index. Even As traditional brick-and-mortar open back up, e-commerce will still able to penetrate their market share because of shifts in consumer behavior that advanced through the outbreak. Another driver of growth is companies desire to reevaluate their supply chains to make them more efficient and less reliant on international suppliers. This will likely increase the demand for warehouse space and domestic manufacturing. As the drive for same-day delivery continues 3rd party logistics companies will pop up to capitalize on the changing landscape.

Overall, the industrial market is well-positioned in the long-term due to growth in e-commerce and the strategic shift in supply chains. In the short term, it is likely there will be drop-in leases and a slight increase in vacancies.

We will continue to monitor and update on the industrial market.