In the last several months more than 9 million California residents filed for unemployment amassing over 50 billion in benefits. Furthermore, rents have been trailing in LA on a 3-month average, 30 basis points below our nation’s average.

The weakening of market fundamentals has slowed transactions in part because of a disconnect between buyer and seller expectations. In the long run, we anticipate rents will correct themselves as buyers acknowledge the world is still spinning and sellers adjust their price expectations. Submarkets with a significant percentage of workforce-level inventory like East Torrance, Sepulveda, and Lancaster have weathered the storm and have all seen rent increases over the last 12 months.

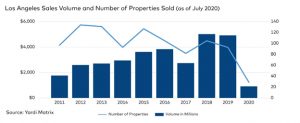

Meanwhile, development has suffered greatly since the outbreak. Over the last 12 months, Los Angeles has experienced its lowest number of units completed since Los Angeles’s decade low in 2012 of 3,274 units. Despite construction being deemed an essential service the lockdown measures and health concerns derailed or slowed development adding to the housing shortage problems. With a lack of development, weakening fundamentals, and a discrepancy in expectations amongst buyers and sellers there has been diminishing transaction activity over the past year. Year to year 965 million less (56%) assets was sold through July.

Here are a few regulatory factors that could potentially affect the value of the commercial and multifamily asset classes.

- Assembly Bill 1482 Rent Control. Rental increases will be limited to a “rent cap” of 5% + the applicable consumer price index. This bill also requires landlords to show a “just cause” to evict tenants.

- Proposal to eliminate 1031 “like-kind” exchanges

- Proposal of eliminating long-term capital gains tax rate

- COVID-19 Tenant and Landlord Protection Legislation. Shields tenants from being evicted due to COVID-19 failure to pay rent as well as back rent owed through February 1, 2021. This is an eviction freeze.

- California Proposition 15 proposes to tax commercial and industrial property at “market” rate instead of purchase price under the current Proposition 13

- California Proposition 21 expands local governments power to use rent control

- AB125 would raise the state income tax rate to 16.8%

California is a pro-tenant state and the above items only make it more difficult for owners of investment properties. We have seen previously active buyers start to sit on the sidelines and wait to see what transpires. This has resulted in less of a buyer pool for commercial and multifamily assets. The good news is commercial and especially multifamily real estate will remain a popular investment tool in Los Angeles as a result of low supply, economic opportunity, and high quality of life that will keep demand high and prices from falling. Even in a circumstance in which the pandemic continues to make transactions and development difficult we should anticipate a growing interest in Opportunity Zone investing as 1031 exchanges become increasingly competitive.